To report non-employee compensation, every sole proprietor and another self-employed party should know how to file a 1099-NEC form. This document has been recently reintroduced by the IRS. Our tax filing guidelines will clarify the Form 1099-NEC meaning, due date, who must file a 1099-NEC form, and where to send the complete template.

What Is Form 1099-NEC: Non-Employee Compensation?

Contents

The IRS Form 1099-NEC is a recent way to report self-employment income used instead of Form 1099-MISC. An updated version of the fillable 1099-NEC form 2022 has been applied since the 2020 tax year so that taxpayers could distinguish between different filing deadlines on forms 1099-MISC and 1099-NEC. The IRS couldn’t match recipient data with the corresponding Form 1099-MISC as some individuals reported small employee compensation and big withholdings in their 1099-MISC forms. Business owners need to file this non-employee compensation form if they made payments exceeding $600 to a non-employee, like an independent contractor, sole proprietor, freelancer, or self-employed person.

Who Can File Form 1099-NEC?

Any business owner needs to issue Form 1099-NEC to each individual whom they have paid no less than $600 throughout the tax year for:

- materials, parts, and services performed by an individual who is not their employee;

- payments for fish purchased in cash from anyone engaged in the trade or catching-fish business;

- payments of attorney’s legal fees.

Note that you shouldn’t report gross proceeds, like settlement payments made to an attorney, using Form 1099-NEC. Instead, address box 10 of a 1099-MISC form. Although 1099-NEC forms don’t apply to C Corporations and S Corporations, there are some exceptions, like legal, health care, and medical payments.

How to Fill Out Form 1099-NEC?

Most people are familiar with filing a free federal tax return. Similar to that process, you can file Form 1099-NEC either online or by mail. To e-file, you can use the IRS’s Filing FIRE system. On average, payers need to file this form by January 31. You will have no automatic 30-day extensions to file a 1099-NEC form unless your business falls under particular hardship conditions.

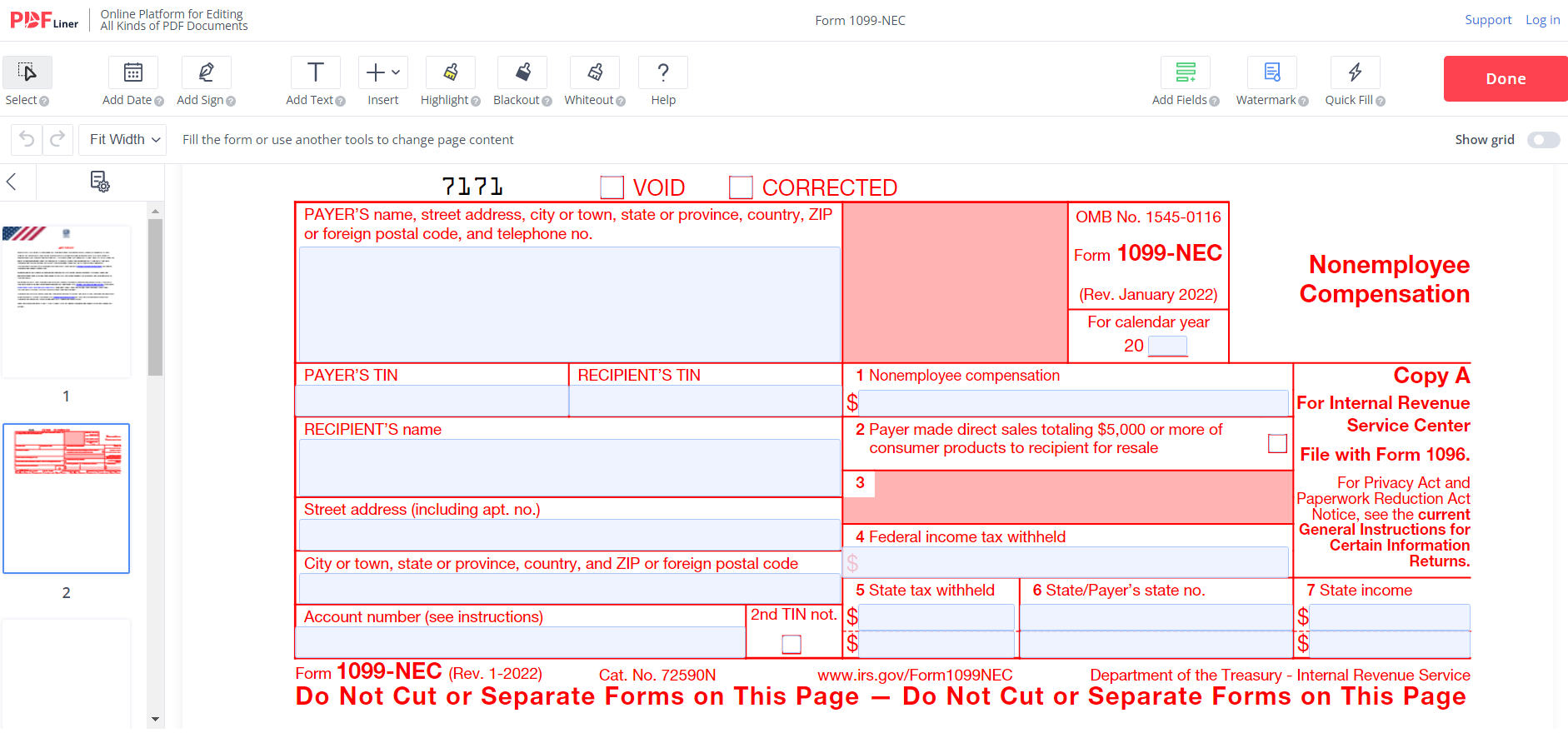

This form is downloadable, and you can get a fillable online PDF template on the official IRS website or any specialized tax filing platform. Each 1099-NEC you submit requires information about your business, like your federal employer ID number, business name, and address. Include the data on the transactions in the appropriate field if that applies to you:

- Enter the ID number of the recipient (SSN, federal tax ID number, or employer ID number) in the sections on the left side of the page.

- Box 1 summarizes the amount paid to the recipient throughout the tax year.

- In field 4, indicate the total backup withholding taken from an individual’s payments during this period. The IRS or a court will notify you if you need to withhold taxes from payments to another party.

- Fill out boxes 5 — 7 since your state’s tax department may require a separate copy of Form 1099-NEC with this data. State the person’s state income, any withheld state taxes, and write down the state(-s) to which you’ll be reporting.

- If you have to indicate data for more than two states, fill out an extra 1099-NEC form.

Check out the complete document for errors and submit the form(-s) to the IRS by the deadline.

How to File 1099-NEC Form?

You can file Form 1099-NEC either online or by mail. To e-file, you can use the IRS’s Filing FIRE system. On average, payers need to file this form by January 31. You will have no automatic 30-day extensions to file a 1099-NEC form unless your business falls under particular hardship conditions.

You may send your completed 1099-NEC forms by mail to the IRS if you file fewer than 250 of them. The mailing address varies depending on your business location. A list of addresses for every state is notified on page 7 of The IRS General Instructions for Certain Information Forms.

Gain Easy Tax Filing Experience

With all useful data in hand, you can simplify reporting of your non-employee compensation. Use our guidelines and the information provided on a 1099-NEC form to fill out the appropriate sections on your tax return. Provide it to a recipient by January 31 of the following year and stay up to date with tax-filing requirements to smoothly run your business. Has the article shed light on any confusion related to filing deadlines of 1099-NEC and 1099-MISC forms? The comments box below is open to your thoughts and questions.

Based on article by pdfliner.com